April, May and June 2019 among slowest months for commercial sales in the past decade

While activity has stayed fairly constant with regard to tenant/purchaser requirements and listings, the deal flow has been slow as most companies continue to have a low risk tolerance in Alberta. Add to this the much anticipated Federal election expected in October of this year, and there has been a mentality of hurry up and wait…until there is a change up federally that is.

Improving Canada's real estate investment and taxation policies - where's our 1031 exchange?

Unless you’ve had the opportunity to be involved with real estate investments in the United States, you may not know what a 1031 exchange is. Also called a like-kind exchange, this is a unique and progressive policy under the IRS that allows allows an investor to sell a property, reinvest the proceeds into a new property, then defer all capital gain taxes until a future date. It improves asset liquidity, increases market transaction volume, and promotes larger capital investment into the market.

The Four Commercial Real Estate Investment Strategies

Core, Core Plus, Value Add and Opportunistic are terms used to define the risk and return characteristics of a real estate investment. They range from conservative to aggressive and are defined by both the physical attributes of the property and the amount of debt used to capitalize a project. Have a look at the following videos and sections, where I’ve briefly explained the differences between the four strategies.

Could Churchill Manitoba be the light at the end of the tunnel?

As it stands, Alberta’s prospects of delivering oil to tide water are grim, if not non-existent. Following the calamitous finale of the Energy East pipeline, and the mismanagement of the western Trans Mountain Pipeline, it seems that our one-customer energy policy could remain in effect indefinitely. But what if there was one more option to consider that could present significantly less inter-provincial conflict, potentially reduced cost outlays, plus economic opportunity for a struggling provincial economy. Would it not be worth investigating?

The truth about Canada's tanker traffic...and its lack thereof.

With 243,000 kilometres of coastline, Canada boasts the longest coastline in the world. Due to the nature of the sea ice in our northern territories, the majority of the northern coastline is untouched by human intervention and ship traffic. Due to the nature of our politics, the majority of our functional coastline in Eastern and more so, Western Canada, is blocked from viable tanker traffic. The rest of the world is aggressively trading with each other, and we’re being left in the dust.

Chinese logistics partnerships with Edmonton International Airport could be the key to more direct flights

The recent partnership announcement of Chinese state-owned EHL International Logistics with Edmonton International Airport clearly exhibits the positive outcomes that are starting to be realized after years of forging relationships with Chinese aviation companies. With no direct flights from Edmonton to Asia at the current time, and witnessing these Chinese state-owned companies pledge their Canadian cargo hubs to Edmonton, I’m inclined to believe that the Chinese State sees Edmonton as a positive business environment, with potential for passenger routes to follow.

Canadian Lodging Industry Continues to Show Positive Momentum

This week I wanted to jump back into my ‘Hotelie’ roots and highlight trends of the Canadian Hospitality Industry. Though not discussed as frequently, the lodging industry in Canada makes up a large part of the commercial real estate transaction volume in our country. In fact, 2016 and 2017 saw roughly $4.1 Billion and $3.5 Billion, respectively, in total transaction volume, the highest numbers in over ten years!

Turning Your Roof Into A Revenue Stream Through Solar Leasing

Around the world, a new stream of relatively passive revenue is benefiting the Landlords of commercial buildings. Read about one method that is mutually symbiotic in benefiting both the environment, and the bottom line, as countries around the world continue to take efforts toward transitioning the consumer’s reliance on energy to new renewable sources.

Over 15 transactions ranging from $10 Million - $63 Million have occurred in Edmonton this year!

For many years, Edmonton has been considered by neighbouring metropolitan cities, a second-tier destination, a "working-class" town. When individuals and businesses from around the world think of Canada, they always first spout out - Toronto, Vancouver, Montreal, Calgary... And while we have primarily been a blue-collar City, this does not mean that our business owners are shy of investment capital, nor does it mean that our City lacks innovation, diversity and opportunity.

The Edmonton International Airport has Attracted 1.6 Million Square Feet of Commercial Development... Since Last Year!

If you've driven past or to the Edmonton International Airport (EIA) lately, you'll likely have noticed that it is a changing and growing landscape. The EIA innovatively came up with a Master Plan for the future of the land surrounding the Airport that involved making available much of the Airport's under-utilized land for the purpose of commercial development by private companies.

Uncompetitive Taxes Shifting Millions of Square Feet of Development to Edmonton's Periphery Markets

This past week at the Edmonton Real Estate Forum, the Industrial Panel took a run at some of the huge challenges faced by industry in the Edmonton market due to the ever increasing property tax rates and reimbursement expectations from our Councillors. With over 1.5 Million square feet of industrial product under construction this past quarter (Q1 2018) and the majority being located outside of Edmonton, what more can we say.

Rumours, proposals & permits - here's what's on the horizon for Edmonton!

What could Alberta's Capital City look like in five years? Here's some of the most influential projects being proposed!

While Canada bickers, USA builds. Here's how they're taking over the global energy game.

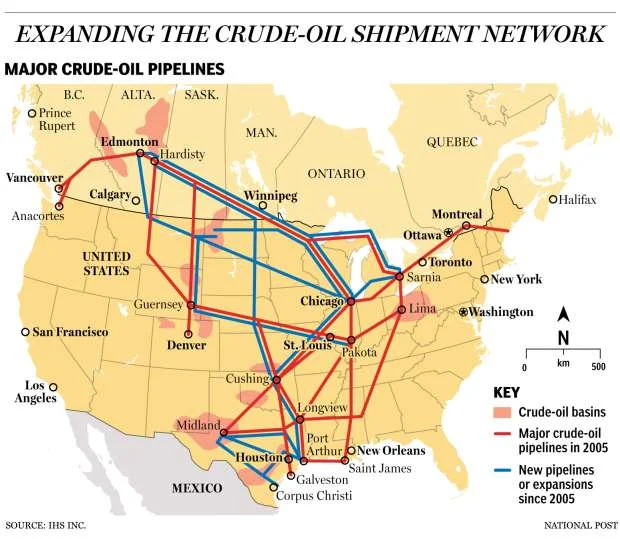

Did you know that in the past eight years since 2010, USA has built the equivalent of ten Keystone pipelines? Meanwhile, we're facing daily protests and delays for the Trans Mountain pipeline, a 980 km (610 mile) expansion project.

Changing the refining game in Alberta - what you need to know

The question facing energy companies today is where best to invest their capital to get their product to market. Should they be investing to build upgraders and refineries here in Alberta to convert bitumen into diesel and gas products locally, or should they continue investing in pipelines to ship heavy product to other markets like Texas where these refineries already exist?

The budding industry that is taking over Alberta

The cannabis industry has proven to be a game changer in states that have already gone through recreational legalization, and from what we are currently witnessing locally, there's no doubt that it is already having a tangible effect on our commercial real estate market here in Edmonton.

Is Amazon aiming for political influence in their HQ2?

The majority of the Top 20 Cities selected, slimmed down from 238 submissions, are located in Eastern USA. But more interesting to me is where the clusters lie - particularly one cluster located around Washington D.C. proper, with three potential locations within neighboring counties. Where the big banks and pharmaceutical giants used to dominate the US lobbying industry, flexing their economic muscle, the new player in town is the tech industry, and in a big way.

Why industrial businesses are looking outside of Edmonton's city limits

The strength of Edmonton's industrial market has a lot to do with the strength of the many surrounding markets that further support the City's industries and connect the communities as a whole. Have a look at this video clip where I discuss the strength of Edmonton's peripheral markets.

The Arena Debate: What have we learned and what can we teach?

It's like a flashback in time right now, a City and its prized NHL team at odds over the future of their athletic program and critically, the home that they will play in. Fortunately for Edmontonians, it's not groundhog day in this Town, but rather, this is occurring in our Sister City of Calgary just three hours south.

Amazon HQ2

It's no secret that Amazon released a Request for Proposals last week to determine the location of their new headquarters - HQ2. Every major City is jumping at the opportunity to have a company of this magnitude enter their market, to say nothing of the billions in capital expenditure and thousands of jobs created. Take a look at what their top decision drivers are here.

The Tsuut'ina Nation Development Strives for Longevity

The Calgary Ring Road Agreement created opportunity for the Tsuut'ina First Nation to formulate a partnership that would bring about success, prosperity and longevity to their future generations. The fortunate developer of choice in what is now one of the largest first nation developments in Canada? Canderel.