While Canada bickers, USA builds. Here's how they're taking over the global energy game.

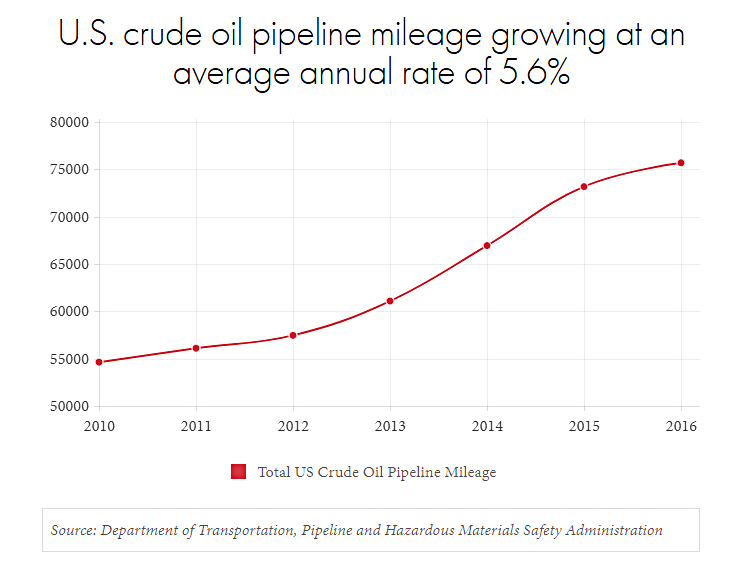

Did you know that in the past eight years since 2010, USA has built the equivalent of ten Keystone pipelines?

When I picture current Canadian economics, the image that comes to mind is a family dinner where the kids are fighting and the parents are...not parenting. Right now, we have a situation where the unity of Canada is being lost to interprovincial squabbling, and federal complacency, over a critical economic life vessel - our pipelines (and the broader well-being of our oil and gas industry). From the failure of Energy East through Quebec, to the upstream battle for the Trans Mountain Expansion through British Columbia, Alberta cannot get its product to tide water, to the benefit of external global players (USA, Saudi Arabia), and the detriment Canada's economy.

Key Takeaways

Many Albertans fear that the federal government will not take clear, direct action that supports their acceptance of the federally approved Kinder Morgan expansion due to upcoming election politics.

Energy investment continues to vacate Canada in droves, walking away from projects, selling off assets, and heading for sunnier skies south of the border.

Meanwhile, the United States continues in growth mode, expanding their share of the oil and gas market to become key producers in the global supply chain, undoubtedly capitalizing on Canada's ineptitude.

Canada's environmental well-being can be harmonious with our economic well-being. Federally, we need to push this mindset because a country with unity is stronger than the sum of its (divided) parts.

Although federally we have heard that the Trans Mountain Pipeline Expansion will proceed, many are beginning to question these comments as Alberta and British Columbia have been pinned against each other in what federally has been called an "inter-provincial disagreement", not unlike how Energy East played out. As a reminder, the Energy East pipeline was a $15.7 billion project that would have spanned 4,500 km (2,795 miles) and carried 1.1 million barrels of crude oil daily from Alberta and Saskatchewan to Eastern Canada refineries. TransCanada walked away from this project in October 2017 due to existing and future delays in the regulatory process, and loud provincial disagreement in Quebec. More recently, the Trans Mountain pipeline expansion, a $7.8 billion project that would add approximately 980 km (610 miles) of new pipeline and increase the system's capacity from 300,000 bpd to 890,000 bpd, is facing scrutiny in BC.

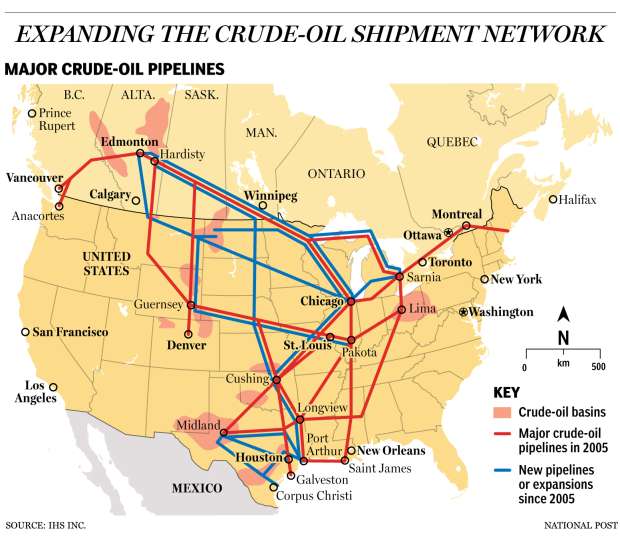

While we self-implode, the United States has been capitalizing on our failures by constructing pipeline on a massive scale, beefing up their production to compete with the world's biggest players. In fact the United States has just surpassed top exporter Saudi Arabia in production with a forecasted 10.59 million bpd output in 2018. This is only growing, and they are expected to take over the top spot from Russia later this year. Since 2010, over 20,000 miles of crude oil pipeline has been constructed in United States. Now let's contrast this to the cancelled 2,795 miles Energy East would have provided, and the tentative 610 miles Trans Mountain would add that is facing daily protests; the scale doesn't even compare.

The crazy part is that the U.S. has manhandled this export opportunity as recently as the last couple years - prior to that, oil exports were largely banned by Washington. The U.S. is transforming global oil markets before our eyes, while we stand idly by. They have managed to transition their reliance away from crude oil imports, eroding the largest market that providers like OPEC had relied on, while simultaneously growing their production to global leading levels. And where is this production heading? To challenge the last region that OPEC dominates - Asia, and more specifically, China. Recent stats from January show China's imports grew to 9.57 million barrels of oil per day, the majority coming from Russia and OPEC, but now being supplemented by U.S. production. U.S. oil is cheaper than other providers which has attracted the Asian markets, to the tune of billions of dollars per year. The only thing hindering U.S. export capability is the inability for the largest oil tankers - Very Large Crude Carriers (VLCC) - to dock at any U.S. ports due to infrastructure constraints. But you guessed it, one of the largest port facilities in the Gulf of Mexico is now expanding to be able to support these VLCC tankers.

For an interactive graphic on U.S. shale oil revolution by Reuters, click here.

At the end of the day, our oil production is some of the cleanest in the world, and like it our not, our economy relies on the the oil industry to flourish. Canadian politics have pigeonholed our energy market into having one customer: USA. Consider this, we don't have enough facilities to process our bitumen locally (see previous blog), so we're in a terrible business situation where U.S. refiners buy our heavily discounted oil sands product, refine it, and send it back to Canada at a premium - we're buying back our own oil at cost plus. We need a strong federal voice that doesn't cater to the whims of the loudest outliers, but speaks up and makes economic decisions, or Canada will soon become the most environmentally responsible country in the world, at the cost of making us one of the poorest developed countries with the highest debt load.