Canadian Lodging Industry Continues to Show Positive Momentum

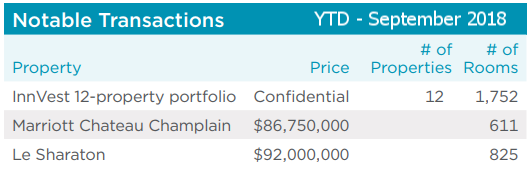

This week I wanted to jump back into my ‘Hotelie’ roots and highlight some of the trends encompassing the Canadian Hospitality Industry. Though not discussed as frequently, the lodging industry in Canada makes up a large part of the commercial real estate transaction volume in our country. In fact, 2016 and 2017 saw roughly $4.1 Billion and $3.5 Billion, respectively, in total hotel transaction volume, the highest numbers in over ten years!

Last week, Cushman & Wakefield released their Canadian Lodging Industry Overview Report, that highlighted many current trends facing the market. I’ve outlined five key points below:

There is ample equity and debt capital available to the hospitality industry, however few quality options for placement due to increasing demands as international investors continue to enter the market.

Pricing in some markets has reached or is near replacement cost, hitting a breaking point for some buyers who are beginning to search south of the border for new opportunities.

Revenue per Available Room (RevPAR) continues to show growth year over year, leading to increased planning, construction and supply across Canadian markets.

Online, consumer-hosted hospitality mediums such as Airbnb, have eaten into classic lodging market share, and continue to pose new risks for hotel owners.

Increasing interest rates and employee wages pose challenges for owners, but the ability to adjust pricing to hedge against these costs mitigates some of the risk.

Source: Cushman & Wakefield

Over the past couple of years, there has been a tangible improvement in tourism throughout Canada. Numerous media outlets and publications have touted Canada as one of the top travel destinations in the world, further enhanced by our sesquicentennial events and National Park promotions last year. With increasing tourism (and a lower Canadian dollar) comes higher occupancy, ADR, and RevPAR for hotels across Canada, though particularly in Ontario, British Columbia, and at our resort cities, such as Banff and Whistler. This bodes well for the hospitality transaction market, where record sales have taken place over the past few years.

"Until recently, investors couldn't fathom paying more than half a million dollars per room. But if you look at the past 24 months, we've had transactions in which the Four Seasons Toronto sold for a valuation of $860,000 a room and the Rosewood Hotel Georgia in Vancouver at almost $930,000," Alam Pirani, executive managing director for the Toronto office of Colliers International Hotels (Globe and Mail).

While this is a Canada-wide view, it does bear saying that the story is not quite so glamorous in Alberta. While it may surprise many that Calgary and Edmonton are ranked first and second in the country for new hotel development, many of these projects were planned and committed to prior to the downturn, and so will likely cause some downward pressures upon completion. The majority of this development in Calgary is centered around the Calgary International Airport, with a total of 3,207 proposed rooms, and a 21.9% growth in supply. In Edmonton, the 15.6% supply growth consists of 2,751 proposed rooms in South and West Edmonton. Unfortunately, while oil prices continue to flounder, Edmonton & Calgary will go on struggling with some of the lowest Average Daily Rates in the country until we are able to find a way to attract investment dollars and diversified businesses to our markets.

For a full rundown of the Canadian Lodging Industry, you can access the report via the button below.

JW Marriott, under construction in Edmonton, AB.