Perhaps the first Alberta-focused Industrial Real Estate Podcast!

I recently had the enjoyment of sitting down with my esteemed colleague and friend, Chad Griffiths, Partner at NAI Commercial, and Gerald Tostowaryk, host of The Real World of Real Estate podcast, to discuss the past year and our upcoming projections for the Alberta industrial real estate market.

The big energy problem, and the [nu]clear solution.

I was pleasantly surprised to hear that Alberta, along with Ontario, Saskatchewan and New Brunswick, have all signed on to help further develop nuclear reactor technology in Canada. The goal of this program is to support the advancement and deployment of nuclear energy through small modular reactors (SMRs), a fresh, new technology that greatly differs from standard nuclear reactors, both in size, flexibility and overall safety.

Three Tech Movements in Building Construction

Technology is impacting the construction industry like never before. An impressive lineup of developments are aiming to improve the efficiencies of a sector that shapes how every human being is able to live their lives.

"Beds and Sheds" hedging to be the front runners for investors in 2020

The catchphrase of the moment is proving to hold its weight as we analyze commercial real estate trends leading into the new year. Canada’s Multifamily market is the strongest it’s ever been with rental rates nearing 10-year highs, apartments near 100% occupancy, and volatility remaining low. On the industrial front, demand for fulfillment space continues to reign supreme to satisfy the multiplying growth metrics in e-commerce.

Improving Canada's real estate investment and taxation policies - where's our 1031 exchange?

Unless you’ve had the opportunity to be involved with real estate investments in the United States, you may not know what a 1031 exchange is. Also called a like-kind exchange, this is a unique and progressive policy under the IRS that allows allows an investor to sell a property, reinvest the proceeds into a new property, then defer all capital gain taxes until a future date. It improves asset liquidity, increases market transaction volume, and promotes larger capital investment into the market.

Could Churchill Manitoba be the light at the end of the tunnel?

As it stands, Alberta’s prospects of delivering oil to tide water are grim, if not non-existent. Following the calamitous finale of the Energy East pipeline, and the mismanagement of the western Trans Mountain Pipeline, it seems that our one-customer energy policy could remain in effect indefinitely. But what if there was one more option to consider that could present significantly less inter-provincial conflict, potentially reduced cost outlays, plus economic opportunity for a struggling provincial economy. Would it not be worth investigating?

The truth about Canada's tanker traffic...and its lack thereof.

With 243,000 kilometres of coastline, Canada boasts the longest coastline in the world. Due to the nature of the sea ice in our northern territories, the majority of the northern coastline is untouched by human intervention and ship traffic. Due to the nature of our politics, the majority of our functional coastline in Eastern and more so, Western Canada, is blocked from viable tanker traffic. The rest of the world is aggressively trading with each other, and we’re being left in the dust.

Canadian oil and gas production is among the greenest and most environmentally innovative in the world. So why are we not branding it this way?

Canadian oil and gas production has long since become the scapegoat of the modern energy contradiction. That is, many around the world are demanding a switch to green, renewable energy, calling for a complete elimination of the oil and gas industry, yet the data shows that global fuel usage from oil continues to grow year after year.

First place you think of when you hear the word Tech? Could be Canada now!

Month after month, we discuss the effects of automation and advancing technologies on the changing landscape of the commercial real estate industry. Whether it's the billions of dollars being invested globally into distribution chain robotics and drones for logistics networks, or the rise of beacon technology emanating from our smart phones to create enhanced and tailored retail experiences, technology is changing the way we do business, and in fact, how we experience life as a whole.

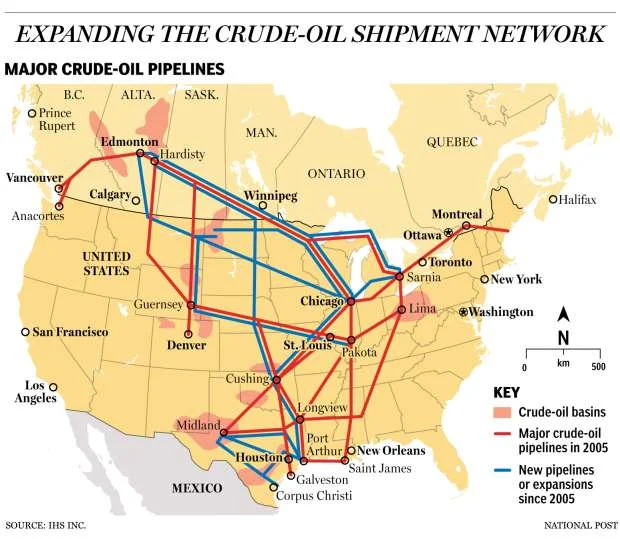

While Canada bickers, USA builds. Here's how they're taking over the global energy game.

Did you know that in the past eight years since 2010, USA has built the equivalent of ten Keystone pipelines? Meanwhile, we're facing daily protests and delays for the Trans Mountain pipeline, a 980 km (610 mile) expansion project.

What's in the stars for the North American industrial market?

While the industrial and commercial markets in Alberta have been far from a pretty picture, The North American industrial market as a whole has experienced a record-setting run, registering some of the strongest leasing tallies and tightest market conditions on record. In particular, the industrial market in the United States, largely due to the huge growth in e-Commerce, has been unstoppable.

Stress-Tests & Rate Hikes & Regulations.... Oh My!

There is a shift happening in the residential and lending markets across Canada. The combination of declining market values, decreased liquidity, rate increases and a new stress-testing model have created uncertainty in the future of our mortgage market as it stands.

"Maple Revolutionaries" - Canada's Pension Fund Giants

Canada's Top 10 Pension Funds collectively manage over $1.1 Trillion and rank as some of the largest in the world. They have created a model for investment management that has become a template and inspiration to public funds on a global scale.

The Big Short: Version 2

There is a new bet on Wall Street that is beginning to gain steam. The bearish short against Commercial Mortgage Backed Securities (CMBS), specifically securities backed by loans taken out by shopping mall operators, is being coined as the next Big Short.

Construction Cost Guidelines

Construction projects are made up of a combination of hard costs and soft costs that must be budgeted with accuracy in order to ensure the success of the project, but what is the difference between these hard and soft costs?

![The big energy problem, and the [nu]clear solution.](https://images.squarespace-cdn.com/content/v1/586a710e9f745649514acf25/1600650508438-SAU7Z5XB7M1QQGH9NI3E/Capture.JPG)