The Alberta Economic SWOT (silent W and T)

I’ve discussed at length the migration of industrial occupiers and capital investment into the Alberta market over the past 18 months due to the convergence of peak levels of demand, affordable development land, available warehouse space and unsustainable pricing in other major Canadian markets. As an industrial real estate broker, I get asked frequently if I’m seeing any slowdown in the industrial market due to increasing interest rates, inflation and lingering supply chain struggles. I’ll outline here why these local and global issues are having a much diluted effect on Alberta.

The big energy problem, and the [nu]clear solution.

I was pleasantly surprised to hear that Alberta, along with Ontario, Saskatchewan and New Brunswick, have all signed on to help further develop nuclear reactor technology in Canada. The goal of this program is to support the advancement and deployment of nuclear energy through small modular reactors (SMRs), a fresh, new technology that greatly differs from standard nuclear reactors, both in size, flexibility and overall safety.

Could Churchill Manitoba be the light at the end of the tunnel?

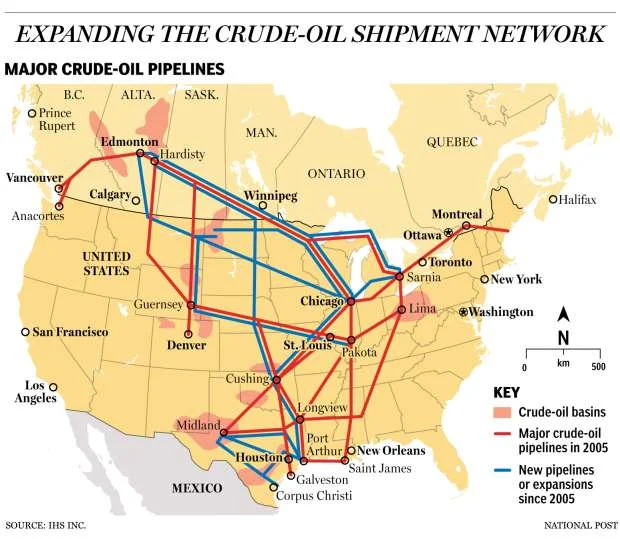

As it stands, Alberta’s prospects of delivering oil to tide water are grim, if not non-existent. Following the calamitous finale of the Energy East pipeline, and the mismanagement of the western Trans Mountain Pipeline, it seems that our one-customer energy policy could remain in effect indefinitely. But what if there was one more option to consider that could present significantly less inter-provincial conflict, potentially reduced cost outlays, plus economic opportunity for a struggling provincial economy. Would it not be worth investigating?

Turning Your Roof Into A Revenue Stream Through Solar Leasing

Around the world, a new stream of relatively passive revenue is benefiting the Landlords of commercial buildings. Read about one method that is mutually symbiotic in benefiting both the environment, and the bottom line, as countries around the world continue to take efforts toward transitioning the consumer’s reliance on energy to new renewable sources.

Canadian oil and gas production is among the greenest and most environmentally innovative in the world. So why are we not branding it this way?

Canadian oil and gas production has long since become the scapegoat of the modern energy contradiction. That is, many around the world are demanding a switch to green, renewable energy, calling for a complete elimination of the oil and gas industry, yet the data shows that global fuel usage from oil continues to grow year after year.

While Canada bickers, USA builds. Here's how they're taking over the global energy game.

Did you know that in the past eight years since 2010, USA has built the equivalent of ten Keystone pipelines? Meanwhile, we're facing daily protests and delays for the Trans Mountain pipeline, a 980 km (610 mile) expansion project.

Changing the refining game in Alberta - what you need to know

The question facing energy companies today is where best to invest their capital to get their product to market. Should they be investing to build upgraders and refineries here in Alberta to convert bitumen into diesel and gas products locally, or should they continue investing in pipelines to ship heavy product to other markets like Texas where these refineries already exist?

The Oil & Gas "Butterfly Effect"

The Butterfly Effect perpetuates that "something as small as the flutter of a butterfly's wing can ultimately cause a typhoon half way around the world" - Chaos Theory. Although the oil & gas market is more of a behemoth than a butterfly, the trends that it maps out have an enormous ripple effect on nearly all other industries, especially in our "diversified" province of Alberta. See my latest video where I discuss this effect here...

![The big energy problem, and the [nu]clear solution.](https://images.squarespace-cdn.com/content/v1/586a710e9f745649514acf25/1600650508438-SAU7Z5XB7M1QQGH9NI3E/Capture.JPG)